Voluntary turnover across all employee categories in 2024 was 24.7%, which is an improvement from our 2023 turnover rate of 30%. We attribute our effective retention rate to a positive employee experience featuring competitive wages, comprehensive benefits, meaningful work, and a sense of belonging and purpose.

Employee Development

To build a pipeline of leadership talent, we recruit internally and externally into our Manager in Training (MIT) program, which is designed to foster the development of participants into leaders across our Company. The program lasts 12-20 months and participants are supported by our executive management team as they are immersed in all aspects of our operations and directly serve and support our customers and suppliers. Upon completion, successful participants are regularly promoted into branch leadership roles within our Company. Participants enter the MIT program on a rolling basis and in 2024 we had an average of 25-30 participants in the program at any given time, which is the highest in our Company’s history.

Additionally, in 2024 we introduced the Leadership Academy, which features two key leadership courses: Foundations of Leadership and Advanced Leadership Principles. Participants are nominated by the Company’s senior leaders and take part in a 6-month program teaching inspirational leadership, personal leadership awareness, team management, people development, leadership skills, and the importance of high performing teams. The Leadership Academy aligns with TopBuild’s core values and leadership expectations and is designed to promote both personal and organizational growth.

Workforce Diversification

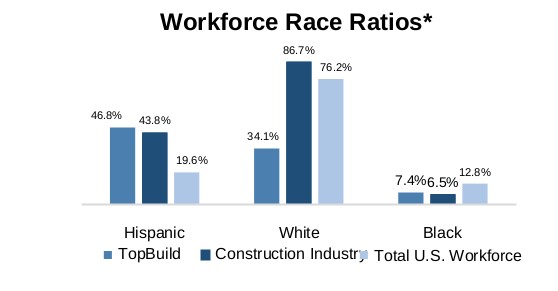

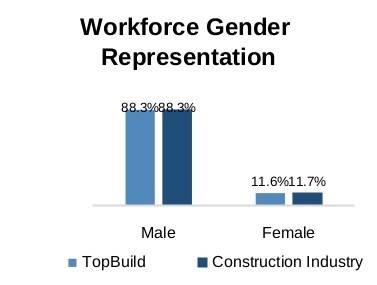

As of December 31, 2024, our employees self-identified as 46.8% Hispanic, 34.1% White, 7.4% Black, 3.8% Other or Multi Race, and 7.8% Undisclosed. Our employees represent a higher racial diversification than both the construction industry average and the total U.S. workforce, as reported by the Bureau of Labor Statistics (December 2024). In addition, our workforce self-identifying as female as of December 31, 2024, was 11.6%, which is in line with the U.S. construction industry female workforce, as reported by the Bureau of Labor Statistics (December 2024). Our corporate leadership team (managers and above) self-identified as approximately 37.7% female, and of all leaders (managers and above) 28.3% identify as non-white or undisclosed.

|

|

*Sums to greater than or less than 100% due to multi-racial reporting.

We acknowledge and are committed to respecting and upholding the human rights and dignity of all individuals within our operations. We have adopted a company-wide Human Rights policy, which is designed to promote a workplace that values and respects the contributions and perspectives of all employees from a variety of backgrounds, skills, and experiences. Company policies, including the Human Rights Policy, are published in the ESG section of our website.

8